Ðåôåðàòû ïî ìåæäóíàðîäíîìó ïóáëè÷íîìó ïðàâó

Ðåôåðàòû ïî ìåæäóíàðîäíîìó ÷àñòíîìó ïðàâó

Ðåôåðàòû ïî ìåæäóíàðîäíûì îòíîøåíèÿì

Ðåôåðàòû ïî êóëüòóðå è èñêóññòâó

Ðåôåðàòû ïî ìåíåäæìåíòó

Ðåôåðàòû ïî ìåòàëëóðãèè

Ðåôåðàòû ïî ìóíèöèïàëüíîìó ïðàâó

Ðåôåðàòû ïî íàëîãîîáëîæåíèþ

Ðåôåðàòû ïî îêêóëüòèçìó è óôîëîãèè

Ðåôåðàòû ïî ïåäàãîãèêå

Ðåôåðàòû ïî ïîëèòîëîãèè

Ðåôåðàòû ïî ïðàâó

Áèîãðàôèè

Ðåôåðàòû ïî ïðåäïðèíèìàòåëüñòâó

Ðåôåðàòû ïî ïñèõîëîãèè

Ðåôåðàòû ïî ðàäèîýëåêòðîíèêå

Ðåôåðàòû ïî ðèòîðèêå

Ðåôåðàòû ïî ñîöèîëîãèè

Ðåôåðàòû ïî ñòàòèñòèêå

Ðåôåðàòû ïî ñòðàõîâàíèþ

Ðåôåðàòû ïî ñòðîèòåëüñòâó

Ðåôåðàòû ïî òàìîæåííîé ñèñòåìå

Ñî÷èíåíèÿ ïî ëèòåðàòóðå è ðóññêîìó ÿçûêó

Ðåôåðàòû ïî òåîðèè ãîñóäàðñòâà è ïðàâà

Ðåôåðàòû ïî òåîðèè îðãàíèçàöèè

Ðåôåðàòû ïî òåïëîòåõíèêå

Ðåôåðàòû ïî òåõíîëîãèè

Ðåôåðàòû ïî òîâàðîâåäåíèþ

Ðåôåðàòû ïî òðàíñïîðòó

Ðåôåðàòû ïî òðóäîâîìó ïðàâó

Ðåôåðàòû ïî òóðèçìó

Ðåôåðàòû ïî óãîëîâíîìó ïðàâó è ïðîöåññó

Ðåôåðàòû ïî óïðàâëåíèþ

Òîïèê: Crisler Corporation. Senior thesis

Òîïèê: Crisler Corporation. Senior thesis

Index

1. History of Chrysler Corporation

2. History of Daimler-Benz Corporation

3. Short Summery of Current Position of DaimlerChrysler

4. Reasons for Merger and New Opportunities

5. Opportunities in New Markets

6. Decrease in Price of Materials Bought from Suppliers

7. Decrease in R&D Expenses per Production Unit

8. Confluence of Technologies of Both Corporations

9. Double Strength of the New Corporation

10. Market Concerns

11. New Corporation

12. Achievements of the New Corporation

13. Survey of Recent Stock Performance

14. Comments on some of Financial Ratios of the New Corporation

15. Government Concerned that…

16. Environmental Issues in the New Corporation

17. Conclusion

History of Chrysler Corporation

It would be true to say that Chrysler Corporation was born long ago before the year 1925 (when it was officially established). It was started as a result of Walter P. Chrysler’s efforts to create a car that would be affordable and competitive in the market. The first car would incorporate four-wheel hydraulic brakes and a high-compression six-cylinder engine.

In 1924, New York for the first time saw a car that became the ancestor of all generations of Chrysler’s cars. It was the Chrysler Six. The car was not allowed to be presented at the New York Automobile Show, because it was not in production. But to put it in production Walter Chrysler needed to raise external funds. Eventually he came up with a very inventive idea—to park his car in front of the building in which the show took place. Going to the show, exhibitors and investors had a chance to see the Chrysler Six. Chrysler’s efforts led to success—a Chase Security Banker underwrote a five million dollars issue of Maxwell Motor Corporation (the company of which Walter Chrysler was a chairman) debenture bonds to finance future development.

In a year Walter Chrysler purchased Maxwell Motor Corporation, renamed it to Chrysler Corporation and became the only owner of it. The new company was growing very fast. By the end of the year Chrysler Corporation had 3800 dealers in the United Stated alone. The profit that year was about $17 million.

In 1934, the company introduced Airflow to the market. This car was a result of engineer Carl Breer’s and Orville Wright’s work. They had been working on a new generation of cars with a teardrop front. Unfortunately this car did not match customers’ tastes. However the company recovered thanks to innovations like ball bearings treated with Superfinish, a forerunner of the automatic transmission (fluid Drive), and the color-coded “Safety-Signal” speedometer. The company continued this success in 941, when it introduced the luxury-oriented Town & Country wagon. This was the company’s first minivan with nine-passenger seating and a rear hatch. Besides that, it was the first minivan with genuine wood exterior panels. This model was in big demand.

On August 18, 1940, the company was shaken by grief: Chrysler Corporation’s founder, Walter P. Chrysler, passed away.

In 1955, Chrysler Corporation debuted its “master piece”—Chrysler C-300. This car was the most powerful full-size car in the world, and soon won twenty out of forty races conducted in 1955.

Chrysler Corporation played a big role in production for military service during World War II. The company’s full capacity was directed toward production of tanks and 40mm trailer-mounted anti aircraft guns. In total, Chrysler participated in sixty-six military projects that were worth of more than 3.4 billion dollars between 1940 and 1945.

With the beginning of the era of space conquest, the Chrysler Corporation actively participated in the construction of powerful engines used to launch astronauts into orbit. NASA chose Chrysler to construct the Saturn 1 and Saturn 1B launch vehicles, which were assembled at its plant in Louisiana.

In May of 1998, an event took place that led to huge changes in the auto world. Two of the world’s most profitable car manufacturers, Daimler-Benz and Chrysler Corporation, agreed to combine their businesses in an equal merger.

History of Daimler-Benz

On October 1, 1883, Karl Benz started his own company, which was called Benz & Cie, Rheinishe Gas Motor Enfabrik. Benz’s cars increased in popularity after he started to build multiple cylinder engines with 16 horsepower, which increased the speed. The sale of automobiles was increasing every year. In the single year of 1901, Benz & Cie sold 2,702 vehicles. By that time, Benz was selling his vehicles in France, England, Russia, United States, and Singapore. Two years later at the age of 60, Karl decided to retire from the car business and the company was taken over by his sons, Eugen and Richand. On April 4, 1929, at the age of 84, Karl Benz passed away at his house at Ladenburg. At the present time, Karl Benz is considered to be a pioneer in car building in Germany and worldwide. In Germany, Benz is a history figure and often there are signs at Mercedes dealerships, which say, “Father Benz."

During World War II both companies, Benz & Cie and Daimler-Mototern-Gesellschaft, were ordered to change their production lines for military purposes. Both companies stopped making cars and began the production of Benz & Cie aircraft engines. DMG was building the aircraft. 1916 was a dramatic increase the number of employees in Benz and DMG factories. The number of workers of the Benz factories increased from 7700 to 12,000 and DMG’s workers increased from 3750 to 16,000. When the war was over, thins became very difficult for the German car builders. Many car-building companies had stopped production and had to close down their factories. Both Benz and DMG were greatly affected by the war and by 1924, the presidents of both companies signed a merger agreement, “Agreement of Mutual Interest,” which made them into one company.

During this time, the Mercedes model became very famous and recognizable around the world. Due to the increased popularity of the model Mercedes, the new company was named Mercedes-Benz. The name Daimler-Benz was used also. For the next decade, the Mercedes-Benz dominated the German automobile market. Mercedes sales were much higher than the other German car companies, such as BMW and Opel.

In the early 1930’s history repeated itself with the rise of Adolph Hitler. The management of Mercedes-Benz began gradually to lose control of the company. The new government brought the vehicle under strict regulation. The whole German car industry was taken over by the National Socialists. Hitler announced that the production of German cars would be “drastically reduced” (Kimer, p. 276, 1986). In the mid 30’s the Mercedes-Benz factories were beginning to be used for military purposes. This idea was given by Jakob Werlen, the former manager of Mercedes–Benz, who later became Hitler’s personal advisor of transportation. An interesting fact is that Hitler had many kinds of cars, but whenever he was photographed in a vehicle, it was a Mercedes. One of Hitler’s favorite models was his parade car, type 770, the “Grosser Mercedes” (Kimer, p. 282, 1986).

Wilhelm Kissel was a general director of the company in the mid and late 30’s. He tried to keep his company free from government involvement, but this proved to be too difficult. By wartime, the Mercedes-Benz factories were basically making military products. By the time Hitler started the war with the U.S.S.R., Mercedes-Benz was making all kinds of army equipment. The German army needed the best machines and Mercedes-Benz factories were producing planes, trucks, tanks, and various kinds of engines. The most famous Mercedes war product was a military plane called Msserschmitt. This plane made the Luftwaffe the best airforce in the world. The Msserschmitt was considered the best plane at that time; it had a Mercedes DB 600 engine, which made this plane much faster than any other planes in the world (Kimer, p. 283, 1986).

In 1945, after the end of the war, all of the Daimler-Benz factories, much like the rest of Germany, were ruined. An American reporter wrote about what he had observed in Germany right after the war - “Cities were dead, factories idle bridges down, rails gone. Rubble was everywhere” (Kimer, p. 283, 1986). World War II completely destroyed Daimler-Benz, at one time the world’s largest automobile company.

It took more than three years to rebuild the factories. However, many divisions of the company were lost because they ended up in East Germany. At first the company was rebuilding U.S. army vehicles. By 1949, over 6,000 cars had been built and the main focus of Mercedes-Benz was again the production of luxury cars (Kimer, p. 290, 1986).

Within the next two years, the company was completely rebuilt and the number of employees since the beginning of the war was doubled. Now the number of workers was almost 40,000. By the year 1952, Mercedes-Benz had built 100,000 cars and 250 in the United States. In 1955, the new models 220, 300, and 300S were introduced in a Frankfort Auto Show and the model 300S was named the car of the year. From that time, Mercedes started to export more cars around the world. However, most of the cars were sold in Germany (Consumer Guide, p. 32, 1986).

By 1960, the Mercedes was the number one selling car in Germany, but at the same time, the BMW became a very close competitor. Mercedes lost a large share of the market to BMW. This was a time when the company started to look for new markets. The United States was a promising market for the Mercedes. In the early 60’s the company increased its sales to 50,000 cars sold in the U.S. (Consumer Guide, p. 46, 1986)

However, in the mid 60’s, the sales went down. The new 190D four-cylinder diesel model did not sell well in the U.S. and Europe. It took the company three years until it became one of the leaders of the market. In 1970, Mercedes introduced three new models, which they called the “New Generation.” The new models were 280S, 280SE, and 280SL. By that time, the Mercedes became the number one imported car in England, France, Belgium, Holland, Switzerland, and Austria (Consumer Guide, p. 48, 1986).

Another reason why the Mercedes became one of the most popular cars in the world was its participation in auto racing. In the late 60’s, Mercedes cars participated in nine races and won seven of them. After tremendous racing results, people around the world wanted to purchase the C-111 model which would set up three new world records; however, Mercedes would not make this available to the public for sale. The company was receiving a thousand letters a day with offers buy the C-111 model and in 1976 the similar model C111-11 was introduced at the Geneva Automobile Show. The new model had tremendous power. It had 350 horsepower, and it could get from zero to sixty mph in six seconds. Its top speed was 190 mph. Also, the C111-11 Diesel set a new record in durability by running at a speed of 156 mph for 10,000 miles straight (Consumer Guide, p.55, 1986).

In 1982, the 190 series was one of the best selling models in the world. The 190 model was a small sized car which opened for Mercedes an entirely new market. In Germany, this model became a best selling car in 1985. This was a very important establishment for Daimler-Benz because the 190 model became the number one selling small car in Germany, leaving the long-time leader, BMW, in second place (Consumer Guide, p. 64, 1986).

In the early 1990’s, the Mercedes market share in the United States was greatly decreased. The reason for this was that the Japanese car companies started to produce luxury cars. For example, Toyota was manufacturing Lexus, Honda was manufacturing Acura, and Nissan was manufacturing Infiniti. These cars today are becoming increasingly popular among Americans. However, German management found a way to overcome the competition by building a Mercedes factory in Alabama in 1994. Now, a large share of Mercedes cars sold in the U.S. are produced by American labor. Producing Mercedes in the U.S. has solved many problems for the company. Many people in the U.S. have an opinion about buying American-made cars with the purpose of supporting the American economy. The second problem was that tax on imports was greatly reduced. The cost of a German laborer was 50% higher than an American laborer in Alabama. By building cars in the United States, all these problems were solved (Fortune, p. 150, 1997).

Similarly, Mercedes used the same strategy in South America. It built a new plant in Brazil. This plant decreased the prices of the cars and made the purchase of a Mercedes more affordable for the South American region (Motor Trend, p. 123, 1997).

In the past five years the demand for 4x4 vehicles has been increasing. Two years ago, Mercedes came up with a new M-class jeep model. The price of the is jeep is around $34,000, which is competitive with the American-made Chevy Blazer, Ford Explorer, and Grand Jeep Cherokee. By making a jeep, Mercedes is keeping up with its competitors for this share of the market. The new jeep is a success because it was named the 4x4 truck of the year for 1998.

Short summary of current position of DaimlerChrysler

Company ownership: European, U.S. and other international investors own DaimlerChrysler; there are approximately one billion shares outstanding. 65% is made up of European investors.

Global Stock: DCX ordinary shares are traded on the New York and Frankfurt stock exchanges as well as nineteen other major stock exchanges worldwide.

Group Headquarters: Stuttgart, Deutschland, and Auburn Hills, Michigan, USA.

Chairmen: Robert J. Eaton and Jurgen E. Schrempp

Management Board: Consists of fourteen members, including the two chairmen and the heads of the operation and functional divisions.

Supervisory Board: Consists of ten shareholders’ representatives and ten employees’ representatives. The Supervisory Board appoints the Board of Management and approves major company decisions.

Market Capitalization: Currently about EUR 80 billion (March 1999)

Investments: 1999-2001: EUR 46 billion to be invested in the future of DaimlerChrysler

Automotive Sales: 4.5 million units in 1998 (Passenger Cars and Commercial Vehicles)

Employees: 466,900 at the end of 1999

Manufacturing Facilities: in 34 countries.

Global Brands: Mercedes-Benz, Chrysler, Plymouth, Jeep, Dodge, Smart, Freightliner, Sterling, Setra, Airbus, Eurocopter, Ariane, Debis and others.

Product sold: More than 200 countries

Official Language: English

Financial Reporting: US-GAAP accounting with earnings reported quarterly.

Reasons for merging and new opportunities.

In 1998, at the Detroit Auto Show, the idea of cooperation of Daimler-Benz and Chrysler Corporation was born. Schrempp, Chairman of Daimler-Benz and Eaton, chairman of Chrysler Corporation, began negotiations about possible combination of two large automobile manufacturers. “We are leading a new trend we believe will change the future, the face of the industry,” Eaton said five months later when the deal was announced.

The two chairmen acknowledged that the merger would not be easy. Their own study of transnational mergers suggested that 70 percent failed to achieve the kind of success that had been anticipated.

As a result of the long series of negotiations, a new company named Daimler-Chrysler was established. The company would manufacture not only cars, but commercial trucks, trains and rockets as well.

The goal of the merger was to create a company that would be able to stand better against other world leading car producers like General Motors, Ford, Nissan, Volkswagen, Toyota and so forth.

With the creation of a new company, both of the old components were going to benefit from the following:

· Decreased R&D expenses per production unit

· Confluence of technologies of both firms

· Double strength in total

· Opportunities in new markets

· Decrease in price of materials bought from suppliers

Opportunities in new markets

Both Chrysler Corporation and Daimler-Benz operate in quite saturated markets (in terms of their current products). In order for them to grow, they will have to carry on those overseas markets, which means development of products in accordance with preferences of the new markets.

Developing new products for a different market segment or establishing an additional brand might have implications for the positioning of the existing product range. Penetration into completely new market segments for both companies would involve both high costs (new offices, stores, and advertisement programs) and substantial risks for the companies.

Another method for successful penetration and establishment in new markets is co-operation with another manufacturer who already has a successful brand and products in place in the segments where it is represented. In this way, the existing product portfolio could be broadened without any risk to each company’s brand identity and its associations of exclusiveness.

Daimler-Benz is well-known and recognized in Europe and USA for its high-quality cars and has firm customers; however, the opportunities are limited. The newly industrializing countries in Latin America and Asia, on the other hand, offer good prospects for growth—starting from a low level—to the premium products segment. To penetrate these fast-growing markets on any scale, however, it would be necessary to launch new, low-priced products, possibly combined with the creation of a new brand name. The new direction will certainly require new funds and the company might not be able to handle this hard task alone. Another possible problem of penetrating the new markets in Latin America and Asia is, was the establishment of new offices, stores, research of new customer’s’ tastes, and advertisement. To cope with this obstacle to its success, DaimlerChrysler seeks companies in those areas for possible merger, like Daywoo, Mitsubisi and so forth.

Chrysler has not penetrated the European market very deeply. It certainly will be a good opportunity for Chrysler Corporation to start cooperation with Daimler-Benz in order to penetrate the European market without additional costs for opening its offices and stores.

At the same time, Chrysler has very a good market in North America and can facilitate Daimler-Benz’s deep penetration into that market with a new program of minivan production.

Decrease in Price of Materials Bought from Suppliers

One major benefit of the merger is that both companies can save lots of money on external purchases. First, saving will take place in purchasing raw materials from suppliers. Before the merger, both companies had to buy from supplier separately. Everyone knows this law of the market: “the more you buy, the less you have to pay.” Now the companies purchase everything together and the quantity of one batch is doubled, this bad led to significant decrease in price on per-unit basis. For example, DaimlerChrysler already saved $1.4 billions in 1998. In turn, decreases in price for raw materials will provide lower prices for the cars in total and increase compatibility of the new company.

Decrease in R&D expenses per production unit

Another positive aspect of the merger is that both of the companies can combine their efforts in researching and developing new products. Before the merger each of the companies had to conduct research for itself and these costs were spread on per unit basis among all products. Now these costs are spread on a significantly larger quantity of products, which allows decreasing costs of the research and development per every production unit. In addition, intellectual powers of both companies will now work for one huge company—DaimlerChrysler. This factor will bring new, combined ideas into the new company.

Facts:

“On April 17, 2000, DaimlerChrysler announced a new Virtual Reality Center in Sindelfingen, Germany. The Company estimates the new facility will reduce costs of making Mercedes-Benz prototype models by up to twenty percent a shorten product development times while improving quality.”

Confluence of Technologies of Both Corporations

Both of the companies have their own advantages, in terms of technological development. Now, when all these advantages represent one solid company, the new company has more chances for surviving in the car manufacturing industry. The following are evidences of recent innovations in DaimlerChrysler.

“DaimlerChrysler researchers in Ulm, Germany, have developed an infrared-laser night vision system that significantly increases a driver’s visibility at night. The system allows drivers to recognize darkly clothed pedestrians and cyclists even at great distances. It also illuminates the road ahead over a distance of around 500 feet without blinding the drivers of oncoming vehicles.

The system functions as follows: two laser headlights on the vehicle’s front end illuminate the road by means of infrared light that is invisible to the human eye. A video camera records the reflected image, which then appears in black and white on a screen located directly in the drivers’ field of vision, or else as a so-called head-up display on the windshield.”(Auburn Hills, April 5, 2000)

Double Strength of New Corporation

One of the factors that investors are looking for before making their investment decision is a company’s overall stability. Usually the large corporations are considered to be stronger than small ones.

The new size of DaimlerChrysler might lead to more stability, which in turn could mean lower rates of return required by investors. It might be one of the new savings aspects of the company.

Market concerns

The automotive industry has seen increased global consolidation over the past two years, The New York Times reported. According to industry analysts, the consolidation is fueled by three major trends: brands growing in importance, manufacturers forging into difficult markets, and rising costs of technology. While many industry experts see the consolidation as inevitable and strategically beneficial, some analysts warn excessive consolidation could lead to diminishing choices and higher prices for consumers.

The Daimler-Chrysler merger is one of the few examples when the merger benefits the competitiveness of the market. Chrysler Corporation manufactures lower-range trucks, minivans, and sport utilities, when Daimler-Benz majors in high-priced vehicles. No significant overlap in production will take place. Since both of the companies specialize in different areas, neither of them will have to give up on some of their production. “There was no real overlap in products –they filled in each other’s blank spaces” said David Cole, the head of the University of Michigan’s Office for the Study of Automotive Transportation. In turn, this meant that there will be no decrease in competition in the market place, which is one of the main concerns of the Federal Trade Commission when a merger takes place. (In a horizontal merger, the acquisition of a competitor could increase market concentration and increase the likelihood of collusion. The elimination of head-to-head competition between two leading firms may result in unilateral anticompetitive effects).

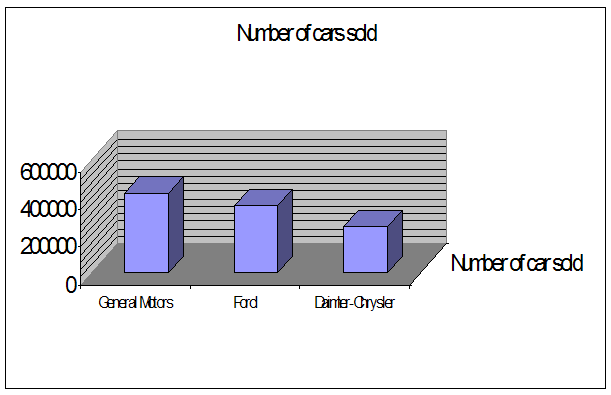

Another concern of The Federal Trade Commission and European

Commission is the possibility of monopolization of the market. The automobile

market is very large and diversified. For example, July 1999 car sales in the

USA for the three largest companies are as shown on the graph:

Even after the merger, Daimler-Chrysler is not capable of keeping such a huge market under control. As one can see on the above chart, Daimler-Chrysler (243420 vehicles) is on the third place in production after General Motors (422029 vehicles) and Ford Motor Co. (355765 vehicles).

In the case of Chrysler Corporation and Daimler-Benz, the hazard of competition decrease does not exist, because the companies produce different types of cars. There would be a decrease of competition if after the merger, one of the companies would have to give up some of its production plans and eventually consumers would be hurt. Instead, it will just intensify competition in the car manufacturing world. On July 24 and July 31 of 1998, the European Commission and the Federal Trade Commission, respectively, approved the merger of Chrysler and Daimler-Benz Corporation, and appearance of Daimler-Chrysler. This merger is classified as a “horizontal merger.”

In order to become the largest car-producing corporation in the world, Daimler-Chrysler has to acquire or merger with some other companies, and this is in fact, what Daimler-Chrysler is looking at right now. On March 10, 1999, Daimler-Chrysler broke off talks about buying a stake in Nissan Motor of Japan, but it has not given up. On March 22, 1999, Schrempp held negotiations with Japan’s Mitsubishi Motors about a possible merger. As it can be seen, the new corporation very actively looks for partners in Asia, but the question that might rise soon will be whether the next merger will be approved by the Federal Trade Commission.

Another fact that might alert the US government is that on February 25, 2000, General Motors Corporation, Ford Motor Corp. and DaimlerChrysler jointly announced that they are planning to combine their efforts to form a business-to-business integrated supplier exchange through a single global portal. Some view this fact as a slow movement towards market monopolization.

Facts:

German-American automaker DaimlerChryslter agreed on March 27, 2000, to buy a controlling 34% stake in Japan’ Mitsubishi Motors Corp. for 2.1 billion, extending its international reach.

The agreement gives DaimlerChrysler access to the Asian market and small-car expertise of Mitsubishi, Japan’s fourth-largest automaker. Carmakers are increasingly seeking cross-border alliances as overcapacity prompts them to cut costs through the sharing of parts and vehicle platforms with manufacturers in a range of markets.

DaimlerChrysler’s deal excludes Mitsubishi’s trucks division, which has an alliance with Sweden’s AB Volvo. Together DaimlerChrysler and Mitsubishi will have a combined market share of about 10.8% in Japan and 9.4% in other parts of the Asia-Pacific region. Daimler’s purchase gives it the right to veto board-level decisions at Mitsubishi.”[i]

New Corporation

Daimler-Chrysler provides a variety of transportation products and financial and other services. It operates seven business segments: passenger cars and trucks (Chrysler, Plymouth, Jeep, Dodge; 43% of 1998 sales), passenger cars (Mercedes-Benz, Smart; 23%), commercial vehicles (Mercedes-Benz, Freightliner, Sterling, Setra; 17%), aerospace (7%), services (6%), Chrysler financial services (2%), and other (2%).

Daimler-Chrysler Corporation is primarily active in Europe, North and South America and Japan and is continuing to expand in markets such as Eastern Europe and East and Southeast Asia (intensive negotiations with Asian companies are obvious evidences of that).

Another aspect of penetrating new markets is that developing new products, opening new stores and offices, hiring managers, and training stuff requires a lot of funds. There are two ways of raising these funds: internal and external. Internal funds come from Retained Earnings. External funds come from loans, bonds, issuance of common stock and other sources. The merger would increase the amount of money in Retained Earnings that could be used in an expansion program. Through the pooling of resources, DaimlerChrysler will be excellently placed to develop and introduce new products even more quickly into the markets, thus gaining an edge over competitors.

Achievements of the New Corporation

“DaimlerChrysler AG today reported a record operating profit of EUR 11.0/$11.1 billion in 1999, the company’s first full year of operations. This is an increase of 28% compared to the 1998 figure of EUR 8.6/$8.7 billion. Adjusted for one-time effects, principally the sale of debitel shares and restructuring expenses at Adtranz, operating profit grew by 20% to EUR 10.3/$10.4 billion. Operating profit thus outpaced revenues which rose by 14% to a record EUR 150.0/$151.0 billion.”

Recently, the German financial magazine “Capital” conducted a survey on the provision of shareholders’ information on the Internet. The overall winner was DaimlerChrysler, which was recognized as the best provider of company information on the Internet.

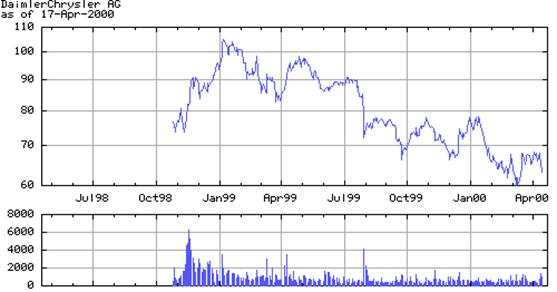

Survey of recent stock performance

Immediately after the merger, the stock price of the new company went up very drastically. The reason for this is that investors strongly believe in the future success of DaimlerChrysler.

Currently, the stock price is down. This fact can be explained by the general performance of the market, which is experiencing very sudden slumps. Many huge companies do not trade at all out of fear of prices drop. Below is the chart of stock price performance of the DaimlerChrysler since the merger.

Below is a valuation of DaimlerChrysler by analysts at Standard & Poor’s.

“DCX has fallen sharply from its early 1999 peak. The automotive sector has been out of investor favor for some time, with DaimlerChrysler contributing to the negative sentiment with its much lower than expected earnings in the second quarter. Despite DCX’s attempt to portray the divergence from expectations as mostly accounting and temporary items, the honeymoon for investors and DaimlerChrysler is clearly over. DaimlerChrysler has a strong balance sheet, with significant cash reserves available for the next industry downturn, as well as for strategic investments and alliances. With strong sales through September, we expect 1999 domestic automotive volume, led by minivans and sport utility vehicles, DCX strengths, to reach a record. Still, given negative investor sentiment and uncertainty in the company’s ability to meet financial objectives, despite a strong third quarter, we would not add to positions.”[ii]

Comments on some of the Financial Ratios of the New Corporation

As the ratios reveals new corporation by some of the ratios overcome industry average. Valuation ratios show us DaimlerChrysler is in better standing in comparison with the industry. Dividends payout ratio proves that the company pays more dividends than average, but I think it is not what investors expected and this lead to a drop in price of the stock.

Financial strength of the company in terms of LT Debt to Equity and Total Debt to Equity ratios is almost twice stronger than the average in the industry. Low return on Equity ratio might be explained by the fact that the company keeps a lot of cash for the purpose of new investment. In general, the company shows strong figures and this view is supported by Standards & Poor’s specialists’ statement. “DaimlerChrysler has a strong balance sheet, with significant cash reserves available for the next industry downturn, as well as for strategic investments and alliances.”[iii]

Government Concerned that...

One of the problems that can arise for the economies of the US and Germany is downsizing of some of the departments. For example, one company does not need two raw material purchase departments. In this case, the new company will need both of its departments because of different languages. The new company will provide more job opportunities for both countries. There are two reasons why this might be so:

1) Expansion plans will require more people to be hired for the new company

2) Because of different languages, much of the documentation has to be translated back and forth.

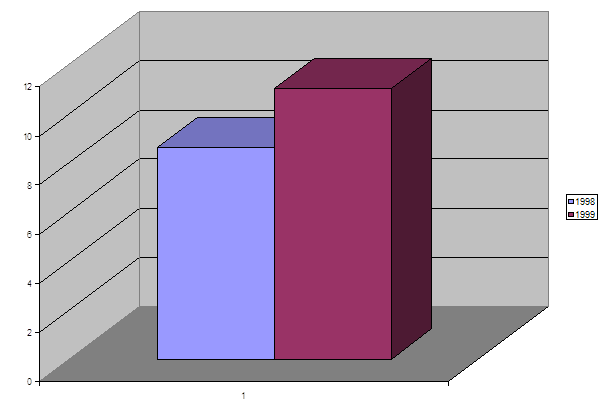

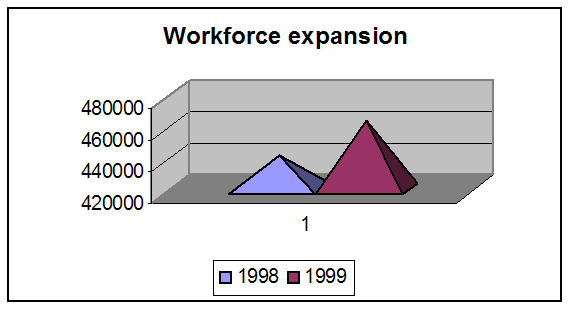

This figure shows expansion so far:

Since both companies are introduced to new markets and new opportunities, they will have to increase their production capacities in order to meet demand in the new market. This factor will require more labor ( as can be seen from the above graph), so more people will be hired. Government does its best to support companies that can provide more employment opportunities for the population, because this contributes to the solution to the unemployment problem. Simultaneously, with the increase of labor involved in the production process, there will be an increase in gross domestic product.

Environmental Issues in the New Corporation

Protection of the surrounding environment and conserving the natural foundations of life should be one of the main concerns of every company and every human being on the Earth. Due to lack of attention to these issues the current environment conditions of the earth have changed dramatically for the worse.

DaimlerChrysler is one of the world corporations that pays a great deal of attention to environmental issues. Its management clearly understands the importance of these issues in the long run. The following facts speak up for themselves:

“DaimlerChrysler and the European Nature Heritage Fund (Euronatur) presented an upbeat review of ten years of environmental cooperation at a press conference in Berlin today. "The concerted efforts of DaimlerChrysler and Euronatur have decisively moved forward environmental protection and habitat security in important large natural landscapes," a joint statement said.[iv]

“On March 29, 2000, DaimlerChrysler’s manufacturing facility in Toluca, Mexico, introduced to production a new wastewater recycling facility. The recycling facility will conserve precious water resources and reduce the potential for pollution by totally recycling all of the water used in the plant.”

In 1998, DaimlerChrysler spent $1.3 billion on environmental protection, according to the company’s Annual Environmental Report. Most of this amount (about $813 million) was spent on research and development activities on green products and manufacturing processes.[v]

Conclusion

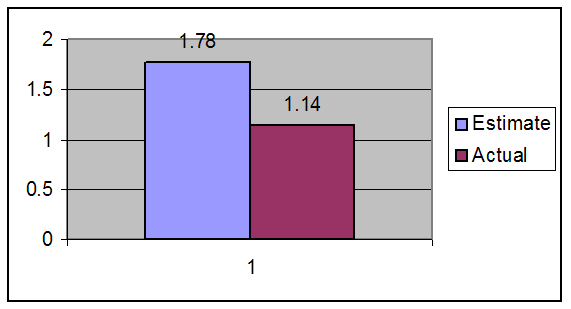

There is only one thing can be said about the future of the new company—it is unclear. As one can see throughout the research, firstly after the merger investors strongly believed in the future of DaimlerChrysler, and as a result of that the stock price soared high. Recently the stock price has dropped significantly, but some believe that it is because entire market experiences slumps. As seen on the prior chart of the stock performance, DaimlerChrysler’s stock price lost 1/3 of its value. Another reason why the stock price slumps is that estimated earnings did not match actual ones. As a December 1999, difference in estimated and actual earning was ($0.64).[vi]

One of the positive aspects of the merger is intensified competition in the auto-production industry. The new company is far from monopolist size in this very giant market. General Motors and Ford Corporation are still main competitors of DaimlerChrysler.

Bibliography

[i] London CNN, http://CNNfn.com/, Monday, 27 March, 2000

[ii] Standard & Poors, Stock Report, March 4, 2000

[iii] Standard & Poors, Stock Report, March 4, 2000

[iv] www.daimlerchrysler.com

[v] www.daimlerchrysler.com

[vi] Yahoo Finance, Market Guide—Multex Earnings Estimates for DaimlerChrysler AG

Indirect sources

1. World Motor Vehicle Data, American Automobile Manufacturers Association, 1998

2. www.yahoofinance.com, Market Guide—Comparisons for DaimlerChrysler AG

3. “The Causes and consequences of antitrust”; the public-choice perspective; Fred S.McChesney, William F.Shughart II; University of Chicago Press, 1995.

4. “The corporate merger”; William W. Alberts & Joel E. Segall; University of Chicago Press, 1966